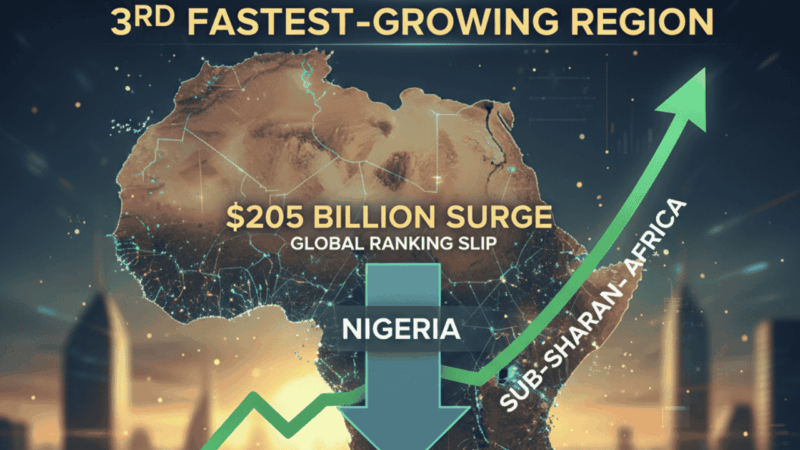

Sub-Saharan Africa has emerged as one of the fastest-growing cryptocurrency regions in the world, according to Chainalysis’ latest Geography of Cryptocurrency report. The study reveals a paradox: Nigeria, the region’s largest crypto market, slipped from second to sixth place in the global adoption index. Yet its activity powered Sub-Saharan Africa to record growth, with the region receiving over $205 billion in on-chain value between July 2024 and June 2025, a staggering 52% year-on-year increase.

This surge positions Sub-Saharan Africa just behind Asia-Pacific and Latin America as the third-fastest-growing crypto region worldwide.

Nigeria dropped from second to sixth in Chainalysis’ Global Crypto Adoption Index. At first glance, it stings. The index ranks 151 countries based on on-chain activity, weighted by population and purchasing power.

India now reigns supreme, followed by the US, Pakistan, Vietnam, and Brazil. Nigeria’s slide isn’t about stagnation, far from it. The country still pulled in $92.1 billion in on-chain value, nearly half of Sub-Saharan Africa’s total.

“So, what happened?” You might want to ask. Chainalysis tweaked its methodology, axing the peer-to-peer (P2P) exchange sub-index as global P2P activity tanked. Platforms like LocalBitcoins shuttered, and Nigeria, a P2P darling, felt the pinch. Meanwhile, other markets like India and the US scaled up institutional and retail activity faster.

It’s less a fall for Nigeria and more a case of others sprinting ahead in a maturing global race. But don’t sleep on Nigeria. Its $92.1 billion haul dwarfs South Africa’s, the region’s second-biggest player.

Bitcoin dominates, making up 89% of fiat-to-crypto purchases, a shield against the naira’s volatility. Stablecoins like USDT, at 7%, are the go-to for dollar-pegged trades in informal markets.

A March 2025 naira devaluation sparked a frenzy, with on-chain volume hitting $25 billion in a single month as Nigerians flocked to centralised exchanges to hedge inflation.

Sub-Saharan Africa’s crypto retail revolution

Sub-Saharan Africa’s rise is even more striking. The region’s 52% growth outpaces most of the world, with $205 billion in on-chain value. Compare that to Asia-Pacific’s $2.36 trillion (69% growth) or Latin America’s 63% surge, and SSA holds its own despite being the smallest crypto economy.

What sets SSA apart is its retail heartbeat. Over 8% of transfers were under $10,000, beating the global 6% average. This isn’t Wall Street-style trading but everyday folks using crypto for real-world needs. Think remittances, bill payments, or small-scale merchant transactions.

The data tells a vivid story. Stablecoins, now 43% of SSA’s volume, are a lifeline for remittances, slashing costs compared to traditional channels’ 7.9% fees. Bitcoin, meanwhile, is a savings vehicle, holding value as currencies like the naira wobble.

Institutional activity is creeping in too. Nigeria and South Africa lead with high-value stablecoin flows for B2B trade, especially with Asia and the Middle East. Energy and merchant sectors are cashing in, using crypto to settle million-dollar deals without the red tape.

A deeper look at Nigeria’s crypto space

Nigeria’s crypto scene is raw, chaotic, and deeply human. With over 200 million people and a tech-hungry youth, adoption runs deep. The report notes 85% of transfers are under $1 million, pure retail muscle. Economic pain pushes people to crypto. When the naira crashed in March 2025, centralised exchanges saw a flood of activity as households and businesses scrambled to protect their wealth.

The Central Bank of Nigeria (CBN) is catching up. After years of hostility, including a 2021 crypto ban, the CBN launched cNGN, a naira-pegged stablecoin, in 2025. It’s a nod to crypto’s staying power. The SEC’s 2025 Investment and Securities Act now treats digital assets as securities, offering some clarity.

Yet challenges loom. Fraud is spiking; Chainalysis’ 2025 Crypto Crime Report flags $178 billion in illicit flows globally over five years. In Nigeria, scams like this and other crypto-related fraud are on the rise. The unbanked, still a huge chunk of the population, need better access.

Beyond Nigeria, South Africa is no slouch. Its $30 billion in on-chain value pales next to Nigeria’s, but its market is sophisticated. Bitcoin takes 74% of purchases, with XRP and ETH hinting at speculative plays. With hundreds of licensed virtual asset providers and banks like Absa building custody solutions, South Africa is an institutional hub.

Ethiopia, Kenya, and Ghana are climbing fast. Ethiopia cracked the global top 20 at 12th, driven by stablecoin use amid currency woes. Kenya’s P2P remittances soared 140%. Ghana’s retail scene is buzzing. Across SSA, DeFi is gaining traction, and altcoins are catching up to Bitcoin’s dominance.

What’s fuelling the fire?

Three forces drive SSA’s crypto boom. First, economic instability. Inflation and devaluation make crypto a hedge and a dollar proxy. Second, financial exclusion. With millions unbanked, mobile-based crypto apps are a game-changer. Third, innovation. P2P trades on WhatsApp and Telegram thrive off-chain, while stablecoins power cross-border commerce.

Global connections amplify this. SSA’s trade with Asia and MENA leans on crypto for speed and cost. Bitcoin’s 89% share in Nigeria reflects savings over speculation, unlike Western markets chasing memecoins.

SSA’s 52% growth is no fluke but represents momentum. Nigeria’s ranking slip is a blip; with clearer rules, it could roar back. Stablecoins will keep climbing, and DeFi could unlock new use cases. Ethiopia’s and Yemen’s top-20 debut signals a broadening base.

For Nigeria, the challenge is balance, fostering innovation while curbing crime. The country’s friendly stance and the SEC’s frequent engagement with industry players are promising. As crypto weaves deeper into SSA’s economic fabric, it’s not just a market; it’s a movement.