In 2020, as the world grappled with COVID-19 lockdowns, Prince Ogbonna faced a problem that many Nigerians know all too well: sending international payments was a nightmare. “It was expensive, slow, and very costly,” he recalls.

Banks were closed, and the traditional SWIFT system, the go-to for cross-border transactions, was a logistical hurdle. Frustrated but undeterred, Ogbonna turned to Bitcoin, a decentralised currency that promised speed and efficiency. What he found was a revelation but also a new challenge.

“The platforms were complex, filled with memecoins and not built for everyday African people,” he says.

That moment of clarity birthed iPayBTC, a Bitcoin-focused payment platform designed to simplify financial transactions for Africans. Today, as the founder and CEO of one of Africa’s leading Bitcoin payment platforms, Ogbonna is on a mission to “Bitcoinise Africa”.

Prince Ogbonna is no stranger to adversity. An entrepreneur with a decade of experience running small businesses, he’s navigated the unpredictable terrain of Nigeria’s economy, learning hard-won lessons in resilience, adaptability, and value creation. These qualities have helped him to steer iPayBTC through the volatile and fast-paced crypto landscape.

Launched officially in 2023, iPayBTC has processed over $2 million in transactions and attracted thousands of users in Nigeria alone. But for Ogbonna, this is just the beginning. His ambition is to make iPayBTC the go-to Bitcoin app across sub-Saharan Africa, transforming how Africans save, spend, and send money.

A solution born from necessity

Nigeria’s financial ecosystem is plagued by numerous challenges, including high transaction fees, currency devaluation, and inflation that erodes savings. For Ogbonna, these weren’t abstract issues but personal pain points.

“I had to make a lot of payments. “It was very frustrating,” he says of his pre-Bitcoin struggles. His discovery of Bitcoin as a faster, cheaper alternative to traditional banking sparked the idea for the startup.

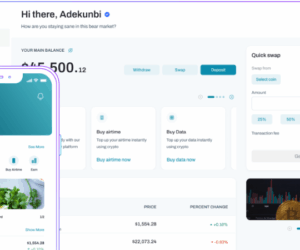

Unlike other crypto platforms cluttered with speculative tokens, iPayBTC focuses solely on Bitcoin, prioritising simplicity and practicality for everyday users. “We see Bitcoin as money,” he explains. “What you can do with cash, you can do with Bitcoin, but better.”

What sets iPayBTC apart is its use of Bitcoin’s Lightning Network, a game-changing technology that enables near-instant, low-cost microtransactions. “Imagine sending 100 Naira with Bitcoin with little to no fee at the speed of light,” he says.

This innovation unlocks real-world use cases, such as buying airtime, data, electricity, or even paying for a haircut. By focusing on utility over speculation, IpayBTC is enabling what Ogbona calls “real economies”.

For instance, one early user, an online retailer importing goods from Asia, slashed restocking times from two weeks to three days by using iPayBTC for instant supplier payments. “Bitcoin offers instant settlement,” Ogbonna notes, a critical advantage in a country where delays can cripple businesses.

iPayBTC simplifies Bitcoin adoption for Africans

For many Nigerians, Bitcoin’s volatility and technical complexity are daunting barriers. Ogbonna’s approach is refreshingly straightforward: education and simplicity. “We don’t encourage speculation,” he says. “We focus on use cases, saving, spending, and earning.”

iPayBTC’s app is designed with non-tech-savvy users in mind, making it as intuitive as mobile payment platforms like PayPal or Flutterwave. The company also invests heavily in education, demystifying Bitcoin through community outreach and student initiatives.

“Our student community is excited about using Bitcoin for savings and everyday spending,” Ogbonna shares, highlighting how young Nigerians are embracing the platform for campus transactions.

This focus on accessibility is critical in a country where inflation outpaces wages. “In Nigeria, inflation and currency devaluation hit people’s savings and business capital,” Ogbonna says.

Since its launch, iPayBTC has made significant strides in Nigeria, processing millions in transactions and building a robust user base. But Ogbonna’s vision extends far beyond Nigeria’s borders.

“Our vision is Bitcoinising Africa,” he declares. Over the next five years, iPayBTC aims to become the leading Bitcoin payment app across sub-Saharan Africa, using Nigeria as a testbed to refine its model before expanding regionally.

His ultimate goal is to weave iPayBTC into Africa’s financial fabric, making Bitcoin as commonplace as cash. He plans to add services like hotel bookings, flight payments, connecting local retailers, restaurants, and more.

Of course, strategic partnerships are central to this plan. By integrating with traditional banking systems, iPayBTC is creating seamless on-ramps and off-ramps for users to buy and sell Bitcoin using their bank apps. “Partnerships allow us to plug into existing systems and expand our reach,” Ogbonna concluded.