…as industry awaits guidelines this week

In a move to support the implementation of the newly enacted Nigeria Insurance Industry Reform Act (NIIRA) 2025, the Securities and Exchange Commission (SEC) has offered nine key concessions aimed at easing the recapitalisation process for insurance companies.

Announced during the 19th meeting of the Insurers’ Committee held in Lagos, these concessions include a reduction in transaction fees from approximately 1 percent to 0.3 percent, the establishment of a dedicated SEC desk to fast-track approvals, and a 14-day approval benchmark after documentation, among others.

The initiative, part of a broader collaboration between SEC and the National Insurance Commission (NAICOM) is expected to accelerate regulatory compliance and drive long-term transformation in the insurance industry.

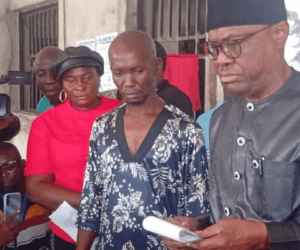

Ebelechukwu Nwachukwu, chairperson of the Sub-Publicity Committee of the Insurers’ Committee, made the disclosure during a media chat at the 19th meeting of the industry body held in Lagos.

She noted that the director-general of SEC, Emomotimi Agama, who made a presentation at the meeting, reaffirmed the Commission’s commitment to insurance industry reform.

Read also: CAC pledges support as NAICOM pushes 12-months recapitalization timeline

According to her, Agama described the insurance industry as the capital market’s strongest ally, adding that this marks the first strong collaboration between NAICOM and SEC.

Quoting the SEC boss, she said: “Already, SEC has raised N3 trillion for the banking sector and believes the insurance sector can do the same”.

Underwriting capital market operations is a growth area, which, according to the DG, only two insurance companies currently leverage.”

Olusegun Omosehin, commissioner for Insurance and CEO of NAICOM, who briefed the industry for the first time since NIIRA was signed into law, informed stakeholders that the new legislation has significantly strengthened regulation across the sector.

Omosehin, according to the publicity Sub-Committee, emphasised the provisions around compulsory insurances, stating that NIRA is a clear signal towards achieving a $1 trillion economy, while aligning the Nigerian insurance industry with global standards.

The Commissioner also highlighted the importance of implementing the Act, stressing that technology and digitalisation cannot be ignored. He spoke about ongoing collaboration between NAICOM and other regulatory agencies, confirming that concessions had been secured from SEC.

Meanwhile, NAICOM is expected to release the recapitalisation guidelines this week, having already collated feedback from insurance operators in recent weeks.

“NAICOM has also issued guidelines on InsurTech and Takaful to guide the industry, and remains committed to ethical practices and fairness to consumers,” Nwachukwu said.

During the meeting, the Commissioner commended the industry for settling major claims, particularly four significant cases recently, which demonstrated the industry’s growing capacity.

He also praised the Nigerian Council of Registered Insurance Brokers (NCRIB) for managing the industry’s public image, especially in a recent case where a party falsely claimed to be insured.

“The matter was later found to be related to the Nigeria Social Insurance Trust Fund (NSITF), not the insurance sector. NCRIB has also secured multiple advertising slots across media platforms managed by the music Icon Ayefele.

The Commissioner noted that risk-based supervision is currently ongoing. While some companies are being visited, he clarified that this is part of NAICOM’s routine regulatory framework and not targeted inspections. He added that a shift to risk-based capital is also on the horizon, with highlights to be disclosed soon.

Health insurance was also emphasized in the NIIRA Act. The Commissioner reminded stakeholders that insurance licenses already cover health insurance, though most underwriters have historically left this segment to Health Maintenance Organizations (HMOs).

He underscored the need to rebuild trust and confidence in the sector. With over 40 million SMEs in Nigeria, insurers were challenged to do more to serve this vital segment of the economy.