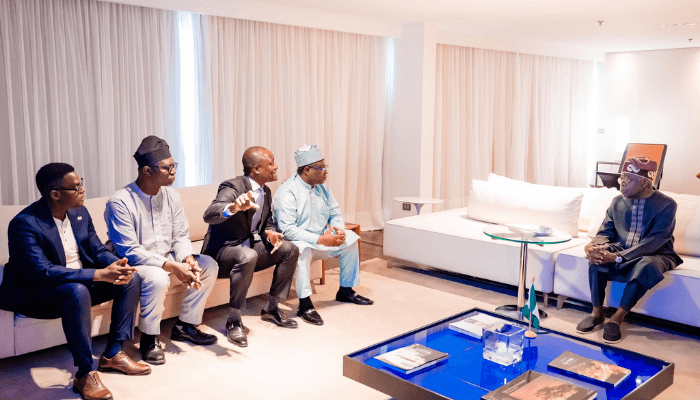

When President Bola Tinubu hosted the Director General of Securities and Exchange Commission (SEC) and the Board of NGX Group during his recent state visit to Brazil, he noted the phenomenal increase in the value and volume of trading on the Nigerian Bourse.

President Tinubu who acknowledged that the dialogue was vital to achieving the Renewed Hope Agenda’s economic targets and positioning Nigeria as Africa’s premier investment destination, also said that his administration’s reforms are broadening investment opportunities for Nigerians and international investors.

Reforms elevating Nigeria’s financial ecosystem…

“Nigeria’s markets must be a trusted engine of enterprise and prosperity. My government will continue to pursue reforms that unlock capital, protect investors, and drive innovation, so that our economy works for every Nigerian,” President Tinubu said.

Read also: Fintech dominates Africa’s private equity inflows amid investment slowdown

Specifically at the meeting, President Tinubu lauded the SEC leadership and the NGX Board for their commitment, affirming his administration’s unwavering resolve to elevate Nigeria’s financial ecosystem.

President Tinubu, who assured his administration’s readiness to protect investors commended Nigeria’s capital market’s remarkable growth since he assumed office over two years ago, also described the market’s performance as a clear reflection of investor confidence in his administration’s reforms and bold economic measures.

ISA 2025 will propel Nigeria toward a N300 trillion market…

Emomotimi Agama, Director General, SEC applauded the recent signing of the Investment and Securities Act (ISA) 2025 and described it as one of Africa’s most comprehensive legal frameworks for capital markets.

He stated that the Act will propel Nigeria toward a N300 trillion market while ensuring equitable wealth distribution through strong investor protection and regulatory clarity.

Fast-tracking major state-owned enterprises listing is crucial….

Umaru Kwairanga, chairman, NGX Group expressed gratitude for the President’s bold reforms, noting that trading volumes and market values have nearly tripled since the commencement of the current administration.

He urged the fast-tracking of the listing of major state-owned enterprises, such as NNPC Limited, and the introduction of tax incentives to sustain this momentum. He also invited the President to visit the NGX trading floor to recognise these achievements.

Expanding retail investor participation through digital channels…

Temi Popoola, CEO, NGX Group emphasised the importance of positioning Nigeria’s Exchange as a global investment hub through stronger partnerships, modernised market infrastructure, and deeper product innovation.

He joined the delegation in thanking the President for his bold reforms. Furthermore, he emphasised that expanding retail investor participation through digital channels will promote inclusive and sustainable market growth.

Read also: NGX Group CEO highlights opportunities for Nigeria–Brazil investment flows

He noted the critical role of capital markets in strengthening Nigeria–Brazil trade and investment ties, particularly by creating growth opportunities for small and medium-sized enterprises (SMEs).

He said the NGX Group is positioning Nigerian market as a global investment hub through global partnerships, modernised market infrastructure, and product innovation.

According to him, NGX Group has been positioned as a gateway for cross-border capital flows and a catalyst for deepening bilateral economic collaboration.

He noted that Nigerian Exchange Limited (NGX), Africa’s second-largest bourse by transaction size, has nearly doubled its market capitalisation in the past 18 months to about $90 billion, covering equities, fixed income, derivatives, and alternative investment instruments.

“Historically, exchanges have been platforms for large corporations, but the reality is shifting. Today, SMEs are critical to our economies, and exchanges must innovate to support their growth,” Popoola stated.

To this end, he explained that NGX has introduced a Growth Board with lower entry barriers for smaller companies, partnered with the Bank of Industry (BOI) to channel funding, and expanded access to alternative financing options through private markets, crowdfunding, and receivables financing.

On cross-border flows, Popoola stressed the ease of investing in Nigeria: “It is easy to invest in Nigeria. Our markets are digital, intermediaries are established, and capital flows freely. Investors who typically allocate funds to Brazil as an emerging market also view Nigeria as an attractive frontier market.”

He further highlighted NGX Group’s leadership in advancing regional integration through initiatives such as the African Exchanges Linkage Project and its recent investment in the Ethiopia Stock Exchange, aligned with the objectives of the African Continental Free Trade Area (AfCFTA).

Nonso Okpala, director, NGX Group Plc, commended the administration’s reforms, citing exchange rate stability and macroeconomic predictability under the Renewed Hope Agenda as drivers of the company’s growth. He encouraged other Nigerian businesses to list on NGX as a pathway to democratising wealth and broadening participation.

Investors in Nigeria’s equities market have continued to reap bountiful returns this year, hovering around 40 percent.

Increased domestic and foreign participation has also significantly stimulated the primary market segment, with more than N6 trillion raised by companies and governments in recent period.

Read also: NAHCO leads stock market return with N20.5m gain on investment

Equities seven months transactions highest in 18 years…

In just seven months to July 2025, Nigeria recorded N6trillion worth of equities transaction, the highest since 2007. Also, the record value of equities transactions in seven months to July doubles the N3trillion recorded in twelve months to December 2024.

Month-on-month (MoM), investors at the Nigerian Exchange Limited (NGX) traded N1.815trillion in July, the highest months transaction. In July, foreign investors traded stocks worth N1.459billion or 8.04 percent while domestic investors were responsible for equities transactions valued at N1.669trillion or 91.96 percent.

The significant increase in the total value of domestic transactions in July 2025 was due to block trades, according to Nigerian Exchange Limited (NGX) in its Domestic & Foreign Portfolio Investment Report for July.

The record high value of trade seen in July is compared to N778.65billion stocks traded in June. In June, foreign investors exchanged stocks worth N1.393billion or 17.89 percent of the total, while local investors traded equities valued at N639.34billion or 82.11 percent.

In January 2025, N607.05 billion stocks were traded on the NGX – foreigner portfolio investors accounted for N715.1million or 11.78 percent while domestic investors were responsible for N535.54billion or 88.22percent of the total equities traded in January. In February, the total value of stocks traded was N509.47billion.

While foreigners were responsible for N426.5million or 8.37 percent of February trade value, domestic investors accounted for N466.82billion or 91.63 percent in the same month. In March 2025, the total value of equities traded by investors was N1.115billion.

Foreign investors accounted for N699.89billion or 62.74 percent while domestic investors traded N415.62billion or 37.26 percent or the total value of stocks traded in March. In April, the total value of stocks traded on the NGX were valued at N482.04billion.

Read also: Africa’s future: The case for investments, not aid

Foreign portfolio investors accounted for N630.7 million or 13.08 percent, while domestic investors were responsible for N418.97 billion or 86.92 percent.

In May, stock worth N700.50billion were exchanged on the NGX. Foreign investors traded equities worth N1.1891billion in May, representing 16.98 percent of the total value of stocks traded, while local investors were responsible for equities worth N581.59billion or 83.02 percent.

The President promised to continue supporting the capital market, while also expressing his readiness to implement additional reforms to strengthen and expand the sector.