Industrial & Medical Gases Nigeria Plc (IMG) has quietly emerged as one of Nigeria’s most profitable mid-cap industrial companies, leveraging prudent balance sheet management and sustained expansion in a sector often overlooked by mainstream investors.

The largest industrial gas distributor in Nigeria, which produces and supplies oxygen, nitrogen, argon, and other industrial gases critical to healthcare and manufacturing, has consistently delivered double-digit profit margins since 2020, and plans to raise N6.4 billion in equity capital, earmarked for deleveraging and capacity expansion.

In 2024, IMG tapped N3.4 billion in debt for capital expenditure, yet it has shown an aversion to balance-sheet risk. Its average debt-to-equity ratio of 0.1x signals a philosophy of growth without overleverage, a stark contrast to peers who often borrow heavily to fund expansion and end up squeezed by rising interest rates.

This prudence has not come at the expense of growth. Over the last five years, IMG’s financial performance has compounded impressively. Revenue has expanded at a compound annual growth rate (CAGR) of 22 percent, while EBITDA has grown by 32 percent.

Net profit has grown even faster, at a 36 percent CAGR, reflecting improving operational efficiency. The company has also sustained an average return on assets of 9 percent and an average return on equity of 20 percent. These metrics underscore a disciplined capital allocation and an ability to generate high returns on relatively modest leverage.

The widening gap between revenue and profit growth suggests strong margin control and pricing power in a sector where cost pass-through is often difficult.

Part of IMG’s strength lies in the essential nature of its products. Its business is built on two pillars. The first is medical gases such as oxygen, nitrous oxide, and carbon dioxide, which are life-saving inputs in hospitals. From respiratory therapy to anaesthesia and intensive care, demand for these products is not discretionary; it is structural.

The second is industrial gases like nitrogen, hydrogen, and acetylene, which underpin oil and gas operations, welding, food processing, and chemicals. For many of its industrial clients, production simply cannot proceed without a reliable gas supply.

This embeddedness in both healthcare and heavy industry gives IMG a unique balance. On one side, the medical gases segment provides defensive, non-cyclical demand tied to healthcare delivery.

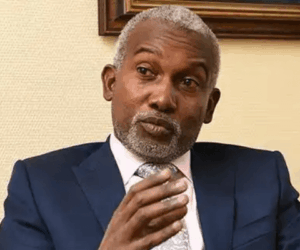

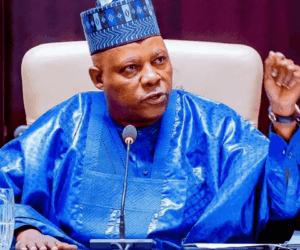

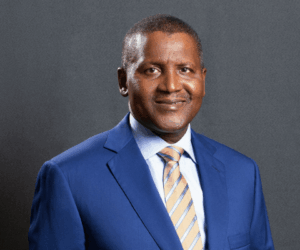

Read also: Industrial & Medical Gases appoints Aminu Ado as new substantive chairman

On the other hand, the industrial gases business connects IMG to Nigeria’s broader manufacturing and energy value chains, where growth opportunities remain significant despite macroeconomic challenges. Few mid-cap companies enjoy such a dual resilience.

IMG’s exceptionality is not just its growth trajectory but also the quality of its earnings. An average return on equity of 20 percent and return on assets of 9 percent suggest the company is sweating its assets efficiently while still being conservative on leverage.

This combination of high returns with low debt is unusual in Nigeria’s industrial sector, where most mid-cap firms either burn capital in expansion or struggle to generate consistent returns.

By maintaining margins above 10 percent and expanding capacity with equity rather than excessive borrowing, IMG has insulated itself from Nigeria’s high cost of finance. This strategy has kept interest expenses low, freed up cash for reinvestment, and preserved shareholder value.

The N6.4 billion equity raise now positions IMG for a new phase of growth. The capital will support capacity expansion at a time when demand for both medical and industrial gases is rising.

Nigeria’s healthcare sector continues to expand, while industries from food processing to energy are scaling operations despite macroeconomic headwinds. If execution matches past performance, IMG may shift from being one of Nigeria’s quietly profitable firms to becoming one of its most strategically important industrial mid-caps.