funding

👨🏿🚀TechCabal Daily: Kenya’s quantitative treasoning

Good morning ☀️

Our friends at Resilience17, a leading early-stage VC, will be in VI Lagos for an AI Builders event on Thursday.

It’s the end of H1, and Resilience17 has asked us to invite you to their free event which brings together founders, investors, and operators to explore AI’s potential for the African startup ecosystem. You can network, learn, and perhaps more importantly 😉, enjoy free food and drinks to celebrate the end of H1. RSVP now by clicking this link.

Protests amplify as Kenya’s Finance Bill moves forward

Kenya started Tuesday with promises that the internet would not be shut down as citizens prepped for mass protests against the Finance Bill moving to the next stage. “It would be a betrayal of the constitution and could sabotage the [Kenya’s] fast-growing digital economy,” the ICT regulator claimed.

So did an internet shutdown happen? By 5 PM Kenyan time, three publications confirmed internet disruptions with Netblocks noting that even X (formerly Twitter) had been affected. Safaricom blamed the disruptions on “damage to fibre optic cables”. Internet shutdowns have become a common tactic to derail protests by cutting off information during uprisings and protests in African countries.

It all comes down: Tuesday’s protest was a last-gasp attempt to pressure Parliament to throw out a bill that will introduce taxes on bread, oil, and banking fees. On Tuesday, 195 Members of Parliament voted for the bill to pass the committee stage, while 104 voted against it.

The protests intensified immediately after the bill was passed, with police firing live rounds resulting in at least eight deaths. Over 12 people are also reported missing. Protesters stormed Parliament and set a portion of the building on fire.

Ruto speaks up and down: On Tuesday President Ruto addressed the country for the first time since the protest against the Finance Bill started. President Ruto claimed Tuesday’s protests were hijacked by “criminal elements” and called the resulting march into parliament “treasonous.”

Military deployed to “help the police”: Things may be heating up! With the mention of treason, Ruto, late yesterday, authorised the deployment of the military to quell the protests. Across social media, millions have joined their voice with Kenyans who will have to wait at least 14 days to see if the President will assent to the bill and make it the law of the land.

Process payments smoothly with Moniepoint

And we’ll have processed almost 5,000 more by the time you’re done reading this. Your business payments can be one of them. Click here to sign up.

World Bank disburses $45 million to NIMC amidst data privacy concerns

In 2020, a World Bank audit exposed several vulnerabilities in Nigeria’s National Identity Database, the National Identification Number (NIN) verification system.

What followed was a “National Digital Identity Ecosystem Project” bundled with an investment pledge of $430 million to help strengthen the national identity and protect personal data and privacy through different projects.

As part of the project, the World Bank sought to help increase the adoption of the NIN up to the tune of 150 million users by June 1, 2024. While the regulator fell short of the set target, boasting 107 million registered NIN users, the World Bank is unrelenting in its support. The bank says Nigeria has made “moderately satisfactory” progress in reaching its set goals.

Yesterday, the World Bank disbursed $45 million to the National Identity Management Commission (NIMC) under the Digital Identification for Development (ID4D) project.

But data privacy concerns persist: The World Bank’s new funding comes amidst a slew of data privacy concerns. Websites like AnyVerify and Xpressverify have been identified among other websites selling the personal information of Nigerian citizens. While the NIMC has debunked claims of a data breach, the vulnerabilities raise concerns about the country’s ability to protect its citizens’ personal information.

The $45 million is the latest tranche of money from the World Bank’s $430 million agreement with the NIMC. The disbursement of funds which has been on since December 2021 is expected to continue.

Issue USD and Euro accounts with Fincra

Create and manage USD & Euro accounts from anywhere. Fincra allows you to issue accounts to your users, partners & customers to collect payments without the stress of setting up and operating a local account. Get started today.

26 startups vie for $220,000 NSIA Prize for Innovation

2023 proved to be a productive year for the Nigeria Sovereign Investment Authority (NSIA) with the completion of the Second Niger Bridge, a project that cost over $76 million. A more impressive feat is that the wealth management agency made $768 million last year alone—with extra income generated from Nigeria’s crude oil sales.

We’ve now gotten word that some of that money might be going to the hands of startups.

The prize for innovation is…In February the Investment Authority turned its attention to the the second edition. The maiden edition awarded a total prize value of $255,000 and received 2,000 applications.

This year’s prize is $35,000 short but it hasn’t stopped 7,000 early-stage businesses from registering for the competition.

At the initial stage, 100 startups reached the preselection stage, but only 26 startups including Sycamore, Jump n Pass, One Health, and VPD, were shortlisted to advance to the Accelerator Stage (physical bootcamp) of the NPI 2.0.

During the week-long boot camp, these startups will engage in interactive training sessions, network with other innovators, and participate in workshops. The boot camp will end in a mini demo day, where start-ups will pitch their solutions to a panel of judges for a chance to proceed to the Demo Day.

The top start-ups will compete for a combined prize value of $220,000 and an all-expense paid five-week training at Draper University, Silicon Valley, USA.

What do you want to see from Paystack in 2024?

Paystack would love to hear from you! Let us know what improvements or new features you’d like to see from Paystack in 2024. Share your wishlist here →

Orange SA to exit Mauritius

What makes a telecom up and leave a country? Sometimes, a business environment goes sour as seen when MTN left war-torn Afghanistan in December last year. Other times, it might be the case of pruning less profitable branches in the case of MTN’s exodus from Guinea Bissau and Guinea Conakry in 2023 to focus on “high-growth” growth markets.

Before we run out of more MTN examples, Orange SA, the French telecom giant is also calling it quits in Mauritius and selling off its entire stake—40%—in the island nation’s biggest telecommunications provider, Mauritius Telecom Ltd.

Why? People close to the matter say Mauritius has become less strategic for the company which is present in 26 countries globally.

Orange SA deemed Mauritius Telecom less important to its business due to its recent rebrand. Mauritius Telecom—which is owned partly by the government (33%), the country’s pension fund (7%)and state-owned SBM holdings (19%)—rebranded as MyT in 2017 following the expiration of its ten-year agreement to use the Orange brand name.

You might wonder “why leave a country because your branding deal has expired?” Well “MyT” just doesn’t have the same ring to it.

Orange marks the exit spot: Orange, which bought its 40% stake in Mauritius Telecom in 2000, is currently discussing its exit plans with its advisors. Orange is yet to discuss with the Mauritius telecom’s board on a share buyback.

While discussions are at an early stage and Orange may choose to remain in the country for longer, insiders say that the company could decide in November.

Calling all business owners!

What keeps you up at night? Is it salary payments, high cost of distribution, or the rising cost of raw materials?

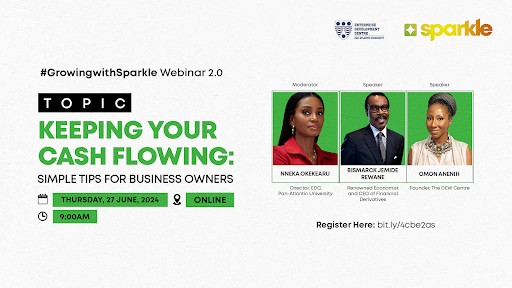

Attend Growing with Sparkle Webinar 2.0. Renowned economist B.J Rewane and Omon Anenih, Founder of Dew Centre, will share tips to help you navigate these challenges and maintain a steady cash flow. Click to register!

- Big Cabal Media – Senior Video Producer, Deputy Editor (Zikoko), Event Production Assistant, Client Account Manager – Nigeria

- TechCabal – Features Writer, Features Director – Africa

- Leadway Assurance – Relationship Officer – Lagos, Nigeria

- Kuda Bank– Content Writer – Lagos, Nigeria

- Quidax – Market Operations Intern, Revenue Assurance Analyst – Lagos, Nigeria

- Carry1st – Growth Manager – Lagos, Nigeria

- Bumpa – Senior Mobile Engineer, Senior Backend Engineer – Nigeria (Remote)

- Comiblock – SEO Specialist, Data Engineer, Machine Learning Engineer – Lagos, Nigeria

Here’s what we’ve got our eyes on

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.